Earlier on Randy's blog I said that I would post the only possible solution to this crisis here tonight. Some people might have thought that Karl Denninger's solution was that post. It was not. This is.

My solution is theoretical. It is a theory called

FreeGold. It is not my theory and it is not new. It has been around for at least 11 years, probably many more than that. But I believe it is the inevitable end to our current situation. And it will either come by natural forces after America has been brought to her knees, or it will be "allowed" to happen and America will retain some of her former glory.

Please bear with me as it is hard to explain in one post what should take a whole book. I will be jumping from concept to concept with only a cursory explanation. Each of these concepts would take up one or more chapters in the book.

Right now the world has its hopes riding on the United States Treasury. The Fed has spent its balance sheet on bailouts that didn't work. And now the Treasury will supposedly come to the rescue. But the Treasury is misnamed. It should be called the gaping hole of nothingness. Or at least the gaping hole of debt. Where is the so-called Treasure? Oh yeah, we do have the gold.

According to the World Gold Council the United States has 8133.5 metric tonnes of gold, the largest stockpile in the world. (Forget that some of that might be IOU's. I'll explain later why that doesn't matter.)

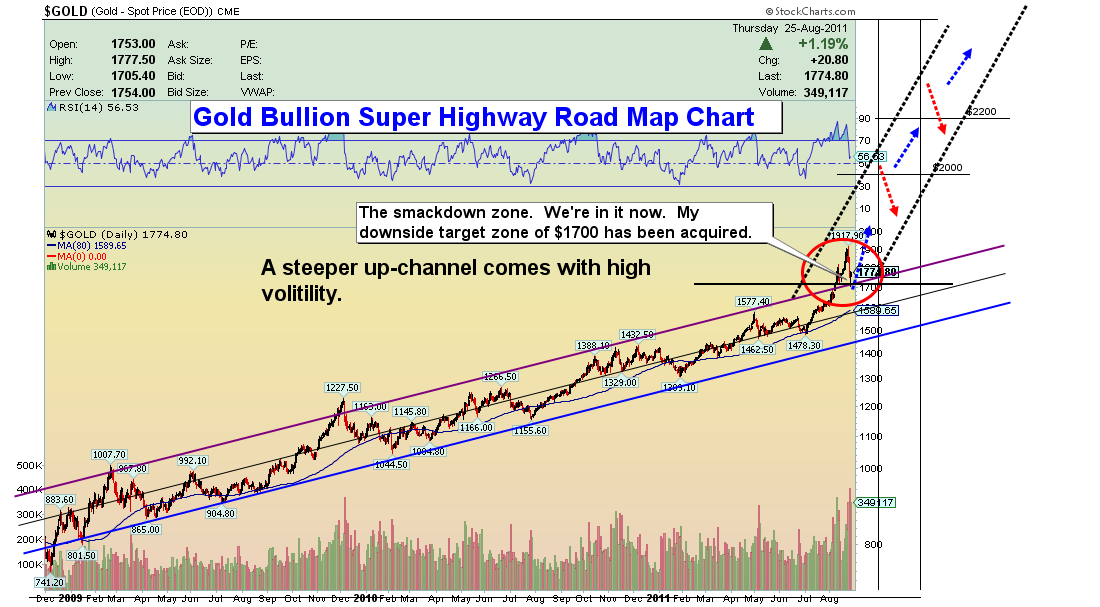

As I type, the price of gold is going down in the Asian markets. It is probable that Hank Paulson and the Working Group on Financial Markets, also known informally as the PPT, the Plunge Protection Team, had a hand in the Asian markets taking gold down tonight. It is one of the many things they do. They believe that if gold goes down in price, the dollar gains strength. This may sound conspiratorial, but it's really not. It is simply a tactic that they use.

FreeGold is based on the theory that gold has a value much higher than what the markets say. The Central Banks of the world are aware of this value. They trade gold amongst themselves based on this higher value. The purpose of the lower gold price on the exchanges is to gain oil from oil producing nations at a low, dollar denominated price. So the low gold price has a real use, a function, that is maintained by the Central Banks.

If the price of gold in the markets was real, then why don't we see countries that are in trouble financially simply selling all their gold for some cash?

It is because gold is really worth more than $50,000 per ounce in today's dollars. I propose to you right now that gold's true value on the world stage is probably $100,000 per ounce in US dollars. And that is based on the dollars in circulation right now. If they print more (which guess what, they are) then the value goes up proportionately.

So now let's jump ahead of ourselves and look at the state of the Treasury with and without FreeGold. Without FreeGold the Treasury is broke. It is insolvent. It is completely reliant on the future taxes to be paid by an economy in trouble. And its biggest asset, gold, is only worth $226 billion. That's hardly a drop in the bucket. But WITH FreeGold valued at $100K per ounce, that same stockpile is worth $26 trillion dollars. Now THAT is enough to be back in business on the world stage. Gold is, and has always been, the United States Treasury's "ace in the hole".

But is this possible? This $100,000 per ounce of gold? How can gold possibly rise that much if it's only at $865 right now? The answer is, it doesn't have to rise. That value is already there. It only has to be set free.

Think about it this way: All the gold in the world is maybe 5 billion ounces. Yet gold is the only "currency" other than the US dollar which is valued EVERYWHERE on this planet. Also, every powerful central bank in the world holds a stockpile of gold as a foreign currency reserve.

Here's the list.

So if there's only five billion ounces, EVERYONE values it, ALL central banks consider it a currency, then how on earth is it only $865 per ounce? Well that can be explained.

If you follow this blog then you know about the deal that was supposedly made between the West and Saudi Arabia in either the late 70's or early 80's. The key to that deal was the ability of the West to basically PRINT paper gold and sell it without limit on the world exchanges. The public was taught that paper gold was as good as physical gold. And the ability to print made gold essentially another fiat currency. So that's where we stand today.

If you hold paper gold you are no safer than if you hold paper dollars. There is an imminent default coming on both.

Now I said earlier that the PPT believes that gold must drop in price for the dollar to be strong. This is not true. Even with FreeGold, the dollar can remain the world's most used currency. Not necessarily the RESERVE currency, but the most used. You see in a world of FreeGold, gold will not be traded. It will be held by those that have it, and desired by those that don't. But only a fool would take a printable piece of paper in exchange for something as valuable as gold.

Now you might give up a piece of your gold in exchange for a house, but probably not for a piece of paper.

Therefore, fiat currencies will still be needed for day to day transactions.

Before gold is set free, we will watch as the exchanges that trade gold as a commodity freeze up. They will remain frozen for a period of time and then all the contracts on those exchanges will be settled in Federal Reserve Notes (also known as dollars). That is all the law requires. No contract can require payment in anything but dollars. That is contract law and that is legal tender law.

Then, after that is done, no gold will trade. Period. At least for a while. Then we will hear about gold being shipped to the Middle East as payment for oil shipments to the West. And we will read about countries exchanging piles of gold to settle trade imbalances. And finally, after a year or so, the true value of gold will be known by all.

So if you have some gold right now, bury it deep. If you don't have any, get whatever you can get your hands on while it's still traded as a commodity. Because believe me... gold is no commodity. It is the only store of value in this world that cannot be easily inflated... and the whole world knows it.

The freezing of the exchanges could happen this week. It could happen next month. Or it could happen next year. I do not know. I only know that this is inevitable. And as ANOTHER says, "It need only be [re]-priced once during the experience of life, that will be much more than enough!"

Oh, and I said I would explain why IOU's in Fort Knox don't matter. Well, those IOU's will be called in when this happens. And they WON'T be settled in dollars. Most of those IOU's are held by Bullion Banks who then hold IOU's from gold mines. If those gold mines cannot produce the physical gold at that time then the mine itself will become the property of the US Treasury. If they CAN somehow provide the gold, that will only give them a temporary reprieve. Soon they will be either "taken" or taxed like you won't believe. In a world of FreeGold you can't have private gold mines out there. That would be like giving a private company the printing press for the dollar.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_bpoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_auoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_yeoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_inoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_zaoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_caoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_cnoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_sfoz_2.gif)